Gold Backed tokens (GBT)

Understanding the problems

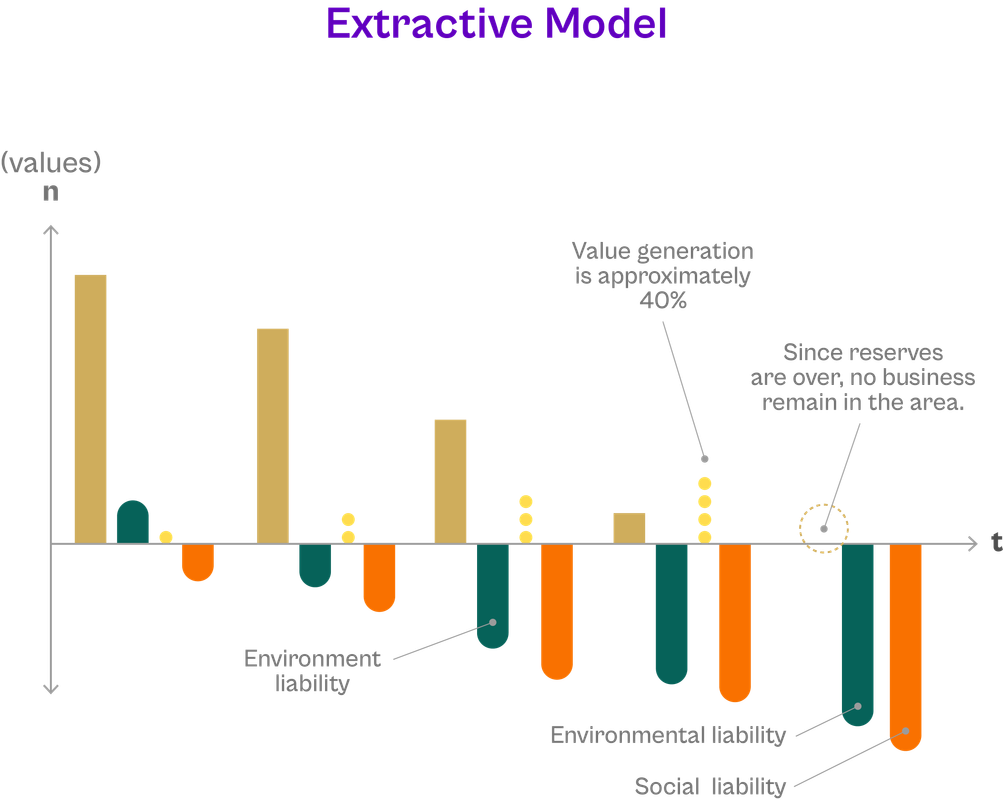

Extractive Model of Gold and Its Consequences

Currently, 90% of extracted gold is primarily used as a store of value. However, this extraction process carries a significant carbon footprint, including the use of explosives, high consumption of fossil fuels during extraction, energy-intensive smelting, and emissions from refineries. Additionally, it involves transportation by plane or helicopter to storage sites, as well as aerial and heavy vehicle transportation to vaults, which continues to consume significant levels of energy to maintain the security scheme, among other factors. Long-term environmental damage cannot be overlooked, such as river pollution, indiscriminate deforestation, loss of vegetation cover, alterations in the water table, and the migration or death of animals.

Some of these damages have large-scale consequences, such as global warming and droughts, all in the name of preserving its value. However, the problem does not end there. Due to the temporary nature of mining activities, long-term employment is not guaranteed as it depends on the existing reserves at the site. This lack of stability in the region leads to long-term social deficiencies, particularly in areas with high mineral wealth but little development. This creates a situation where investment in a town or region may not be sustainable over the long term, especially in developing countries that contribute a significant percentage of the world’s gold production volume. This exemplifies a win-lose economic relationship, where considering the problems derived from the process, it could be viewed as a lose-lose situation.

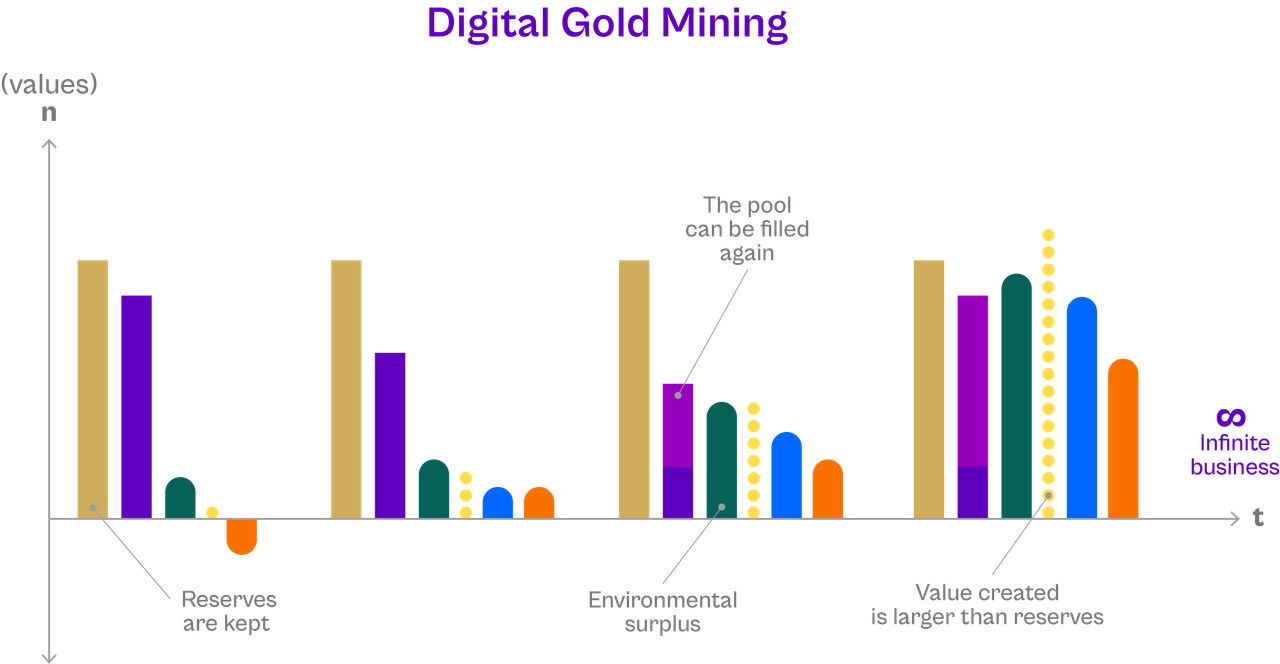

As seen in the image above, the extractive model is a finite business where once the mining reserves are depleted there is no further opportunities for the community generating large social problems while the environment remains disrupted.

"We have been destroying our nature to take the gold out from its natural vault, smelt it and save it in a place where nobody will see it again"

What Do We Propose?

ALTERNUN proposes a disruptive change by capturing the value of gold mining reserves through “Digital Gold Mining” in liquidity pools. This innovative strategy not only offers investors a safe haven as a store of value but also provides them with the opportunity to generate profits by executing projects while making fully decentralized decisions. This change reverses the negative dynamics associated with mining, allowing for long-term value generation and delivering environmental benefits, social development, and economic diversification. Additionally, it contributes to building a strong connection to the territory.

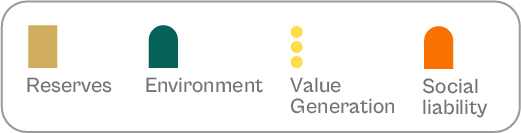

Liquidity Allocation

| Entity | Allocation (%) | Motivation |

|---|---|---|

| Miner | 8 | Becomes a curator, protecting the reserves underground. |

| Nation | 2 | Offers a clear solution to the conflict of interest; now the nation can collect taxes while protecting the environment. |

| Exploration | 5 | Continues exploration to increase certainty and, if possible, reserves. |

| Community/Marketing | 2.5 | Reserved for community token holders** to swap ATN with GBT and promote projects. |

| Projects Feasibility | 2.5 | Funds feasibility studies before committing liquidity, managing project risks. |

| Recovery Pool | 30 | Provides liquidity for extraction if necessary, also buys gold produced in exploration to strengthen reserves. |

| Projects | 50 | Funds regenerative projects; 80% of profits shared with GBT holders. |

** Learn more about the community and rewards token Here.

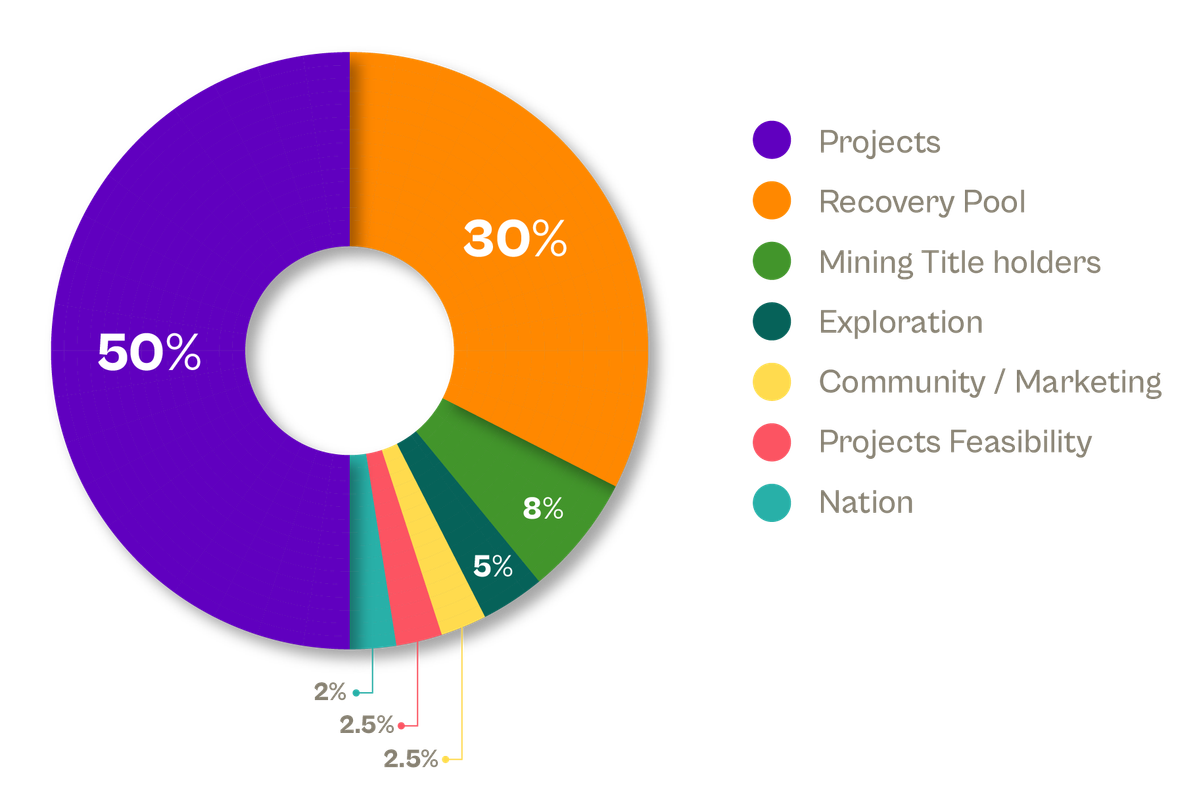

Liquidity management

We have designed a clear way to manage the liquidity including a decentralized way to take the decisions about how to invest or decide the future of the gold mine reserves.

80% of the resources are controlled by the DAO, where the holders can participate in the election of the projects and by a staking process the users can decide if they want to transfer their liquidity to an approved project. This means that even if the DAO approves a project, a user can decide to not invest on it, giving freedom to the user.

Every time a project proposal is accepted, ALTERNUN will conduct a project feasibility study using the resources reserved for that purpose, the results will be shared with the community and if the project is feasible, then a staking feature will be unlocked so the users can start to participate in the project.

Learn more about projects election and its management Here.

The profits of the projects go directly to the stakers by 80%. 15% is for Alternun as manager of the project and 5% is sent back to the liquidity pool generating a virtuos cycle that will generate more funds to invest.

How Digital Gold Mining looks in the long run

Thanks to the regenerative approach created by the liquidity pool allocation, when reviewed the long term results we can find that is possible to create an infinite business where the liquidity pool continues supporting the development of impact project and these help to regenerate the environment and to develop the communities.

In the image above, you can see how the gold resources are preserved, and a new bar representing the liquidity pool is created. This new bar decreases while a new blue bar begins to rise, symbolizing the projects developed using liquidity pool resources. The liquidity pool is replenished with a part of the profits generated by these projects, contributing to environmental regeneration, providing long-term opportunities to the community, and creating value for token holders. The liquidity pool is also funded by the regeneration credits sold in the market.

If you want to learn how Alternun impacts the SDGs, please click Here.

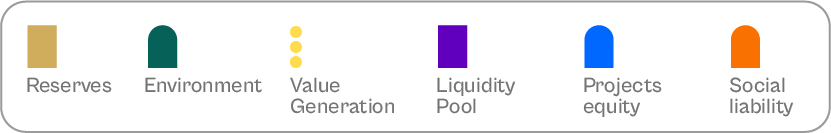

Process required to create a digital gold mine

To generate a digital gold mining operation there are certain steps that are required to fulfill in order to give as much trust as possible to all the holders.

We have comprised these in 5 steps:

1 A legal mine: We make sure that the mine that is going to be included in the process has the licence to opperate.

2 Exploration: The exploration helps us to understand and know better the situation of the mine. It gives valuable information about the mechanisms to extract the gold and also about the amount of gold that may be in mine.

3 NI43-101 report: This report was designed to evaluate all the data from the mine, from its licence to the exploration data. This report is performed by a QP (qualified person) who has plenty of experience and has been certified to sign this kind of instruments. Having a NI43-101 is extremely neccesary to create trust among the possible holders.

4 Tokenization: Using the results of the report, we decide the amount of tokens that are going to be created. This follows some rules accoridng to the level of certainty and the cost of selling the gold in the market, both elements explained in the next section.

5 Liquidity pool: The liquidity pool is created following the rules explained in the prior sections,looking to decentralize and manage the resources according to the ethos of the project.

Relationship Between GBTs and Unmined Gold Resources

Gold resources underground are categorized based on certainty levels rated by the QP and expressed in the NI43-101. These resources are tokenized to provide collateral for GBT holders.

| Level | Description | Collateral (%) |

|---|---|---|

| Inferred Resources | Low certainty level; minor data | 15 |

| Indicated Resources | Medium certainty level; enough data for mining plan | 30 |

| Measured Resources | High certainty level; detailed mining plan possible | 60 |

| Probable Reserves | Medium certainty level; 50%-90% recovery potential | 50 |

| Proven Reserves | High certainty level; over 90% recovery potential | 70 |

The Collateral Gold Grams (CGG) calculation adjusts based on commercialization margin (CM) factors specific to each country.

Example 1

Colombia CM: 20%

Gold mine in Colombia. Indicated resources: 2,100,000 gold grams.

- CGG = Resources _ category % _ (1-CM)

- CGG = (2,100,000 _ 30%) _ 0.8

- CGG = 504,000

Minting GBT

GBTs can be minted using USDC and EURC. Liquidity used for minting is allocated according to the table above. A variable commission based on the gold price is paid to Alternun during minting.

GBT protects holders against inflation and crises due to its gold backing. Holders can participate in governance and regenerative projects.

Supply Transparency

GBT initial supply is set by ALTERNUN based on the first report produced by the QP. transparency is maintained through ongoing exploration reports. Additional supply may be authorized by DAO to increase collateral percentage, ensuring token strength and reflecting new resource discoveries.

Example 2

Continuing from Example 1:

- CGG = 504,000

- Initial Total Supply (ITS) = 504,000 GBT (one token = one gram of gold)

After exploration, the QP reports new resources:

- Indicated resources: 2,800,000 gold grams.

- Difference: 2,800,000 - 2,100,000 = 700,000g

- CGG = (700,000 _ 30%) _ 0.8

- CGG = 168,000

DAO approves to increase the total supply:

- Reserves = 168,000 * 20%

- Reserves = 33,600

- Additional total supply = 134,400

- New total supply = 504,000 + 134,400 = 638,400 GBT

Grams underpinning each token = 672,000 New minting price: Grams underpinning each token / Total supply New minting price: 672,000 / 638,400 = 1.052 Gold grams.

Example 3

Continuing from Example 2:

If new exploration reports increase resources further, the DAO may decide to expand the total supply again to maintain collateral strength:

- New resources: 3,500,000 gold grams (including previous indicated resources and new findings).

- Difference: 3,500,000 - 2,800,000 = 700,000g

- CGG = (700,000 _ 30%) _ 0.8

- CGG = 168,000

DAO approves to increase the total supply:

- Reserves = 168,000 * 20%

- Reserves = 33,600 + 33,600 (previously reserved) = 67,200

- Additional total supply = 134,400

- New total supply = 638,400 + 134,400 = 772,800 GBT

Grams underpinning each token = 840,000 (total supply + reserves) New minting price: Grams underpinning each token / New total supply New minting price: 840,000 / 772,800 = 1.0869 Gold grams.

Token Uses or Benefits

- Protection against inflation since the token is collateralized by gold mining reserves.

- Governance: Holders will have the right to vote and decide which projects should be developed.

- Staking: Holders can use their tokens to stake into projects to participate in regenerative projects.

- Special Features: Holders will be allowed to claim special rewards according to the mine or area they are supporting such visits to the old mine tunnels, walks in the regenerated areas, among others.